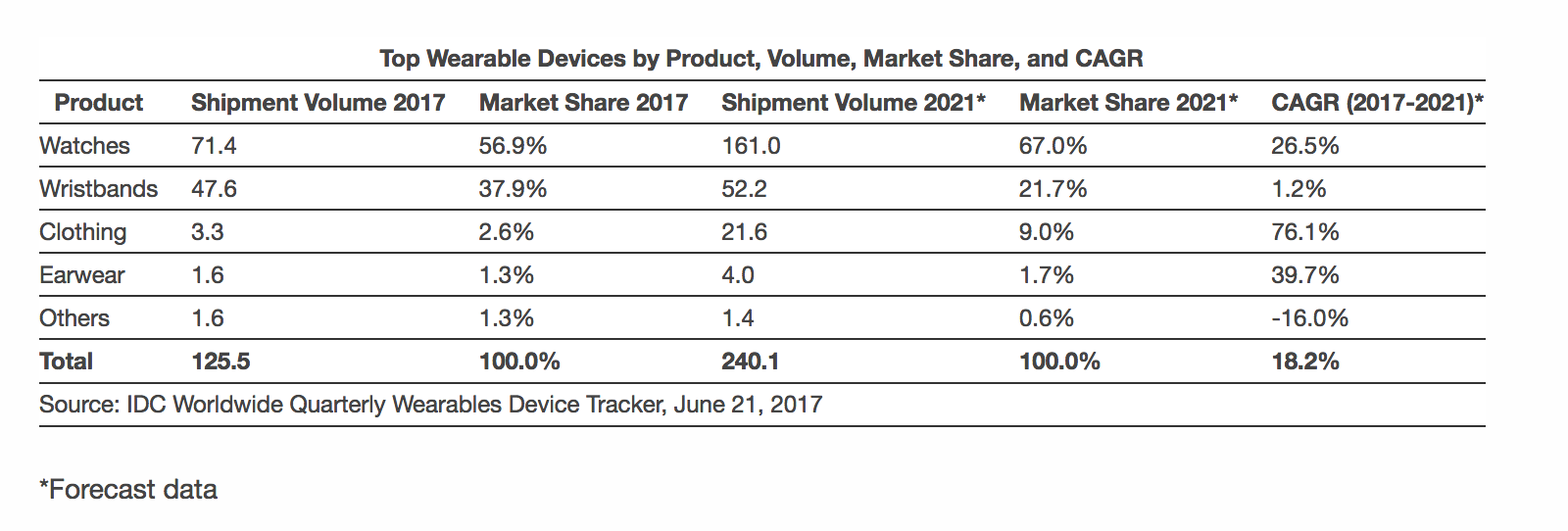

Total shipment volumes of wearables are expected to maintain their forward momentum, says IDC. According to data from the Worldwide Quarterly Wearable Device Tracker, vendors will ship a total of 125.5 million wearable devices this year, marking a 20.4 per cent increase from the 104.3 million units shipped in 2016. From there, the wearables market will nearly double before reaching a total of 240.1 million units shipped in 2021, resulting in a five-year CAGR of 18.2 per cent, according to IDC forecast data.

“The wearables market is entering a new phase,” points out Ramon T. Llamas, research manager for IDC’s Wearables team. “Since the market’s inception, it’s been a matter of getting product out there to generate awareness and interest. Now it’s about getting the experience right – from the way the hardware looks and feels to how software collects, analyzes, and presents insightful data.”

“It’s not just the end users who will benefit from these advanced devices,” said Jitesh Ubrani senior research analyst for IDC Mobile Device Trackers. “Opportunities also exist for developers and channel partners to provide the apps, services, and distribution that will support the growing abundance of wearables. From a deployment perspective, the commercial segment also stands to benefit as wearables enable productivity, lower costs, and increase ROI in the long term.

IDC anticipates watches will account for the majority of all wearable devices shipped during the forecast period. Basic watches (devices that do not run third party applications, including hybrid watches, fitness/GPS watches, and most kid watches) will continue out-shipping smart watches (devices capable of running third party applications, like Apple Watch, Samsung Gear, and all Android Wear devices), says IDC, as traditional watch makers shift more resources to building hybrid watches, creating a greater TAM each year. Smart watches, however, will see a boost in volumes in 2019 as cellular connectivity becomes more prevalent on the market.

Once the overall leaders of the wearables market, wristbands will see slowing growth in the years ahead, says IDC. The sudden softness in the wristband market witnessed at the end of 2016 will carry into subsequent quarters and year, but the market will be propped up with low-cost devices with good enough features for the mass market. In addition, users will transition to watches for additional utility and multi-purpose use.

[Image courtesy: Fitbit]