According to the IDC Worldwide Quarterly Server Tracker, vendor revenue in the worldwide server market increased 26.4% year over year to $20.7 billion in the fourth quarter of 2017 (4Q17).

The server market continues to gain momentum, as traction for newer Purley- and EPYC-based offerings grows, according to IDC. While demand from cloud service providers has propped up overall market performance, other areas of the server market continue to show growth now as well. Worldwide server shipments increased 10.8% year over year to 2.84 million units in 4Q17, according to IDC.

Volume server revenue increased by 21.9% to $15.8 billion, while midrange server revenue grew 48.5% to $1.9 billion. High-end systems grew 41.1% to $2.9 billion, driven by IBM’s z14 launch last quarter. IDC expects continued long-term secular declines in high-end system revenue, with short periods of growth related to major platform refreshes.

Hyperscalers remained a central driver of volume demand in the fourth quarter with companies such as Amazon, Facebook, and Google continuing their datacenter expansions and updates, says IDC. ODMs continue to be the primary beneficiaries from hyperscale server demand.

Some OEMs are also finding growth in hyperscalers, but the competitive dynamic of this market has also driven many OEMs such as HPE to focus on the enterprise, says IDC. For example, HPE/New H3C Group grew 38.6% and 114.6% in High-End and Midrange Enterprise Servers, respectively.

Other highlights in the quarter include robust growth from Dell, which continues to capitalize on expanded opportunities from its merger with EMC, and IBM, which experienced another successful quarter from its refreshed system z business.

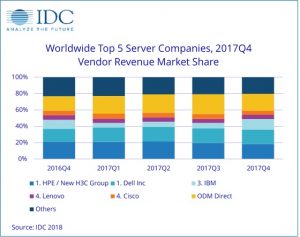

Overall server market standings, by company

HPE/New H3C Group and Dell were statistically tied for first in the worldwide server market with 18.4%, and 17.5% market shares respectively in 4Q17. HPE/New H3C Group revenue increased 10.1% year over year to $3.8 billion, while Dell increased 39.9% year over year to $3.6 billion.

HPE’s share and year-over-year growth rate includes revenues from the H3C joint venture in China that began in May of 2016; thus, the reported HPE/New H3C Group combines server revenue for both companies globally.

IBM captured the third market position at 13.0% share with revenue growing 50.3% year over year to $2.7 billion.

Lenovo and Cisco were statistically tied for fourth position. Lenovo had 5.3% share, with revenue increasing 15.1% to $1.1 billion and Cisco had 5.1% share with revenue increasing 14.8% to $1.1 billion.

The ODM Direct group of vendors grew revenue by 48.1% to $4.2 billion. Dell led the server market in terms of unit share at 20.5%.

[Image courtesy: IDC]